Choosing the right accounting software is a critical step for any new business.

This article reviews the best accounting software for small businesses to help you decide which features are most important to you.

Finding the right accounting software could have been a difficult task a decade ago; however, the proliferation of cloud-based accounting software options now provides startups with a plethora of cost-effective, user-friendly options.

This article also looks at a number of accounting products that are suitable for a wide range of startups in a variety of industries.

Here are some recommendation about best startsup accounting softwares:

Best startup accounting software

We will tell you about the description of the software, its benefits, and its prices:

Tipalti Approve

Tipalti Approve is a leading bookkeeping platform for startups.

It is a premier procurement management solution that streamlines critical financial processes ranging from purchase request management to approvals.

PO generation, flexible forms, and duplicate requests are also important features.

Tipalti Approve also includes team management tools. Centralized communication with file attachment support is one of them.

It is also praised for its robust reporting and analytics features, which include simple visualizations. Smart view filters and budget data are also included as reporting features.

Finally, the solution is available in three quote-based plans.

Features:

- Flexible Forms for PO Generation

- Onboarding of Vendors

- Smart View Filters for Budget Data

- Duplicate SSO Integration Requests

- Communication Has Been Centralized

AvidXchange

AvidXchange is a payment automation and invoice management suite that startups use for bookkeeping.

It is intended for SMEs looking to move away from paper-based processes and toward digital automation.

Spend management, purchase order application, invoice application, supplier portal, invoice accelerator, cash management, and, of course, a general ledger are all important features.

All of these features are housed in an extremely user-friendly web-based interface.

Furthermore, AvidXchange is highly customizable.

In fact, it is used by a wide range of businesses across all industries.

Finally, AvidXchange is only available through quote-based plans because it is deployed based on your company’s needs.

Features:

- Spending Control

- Services for Billing

- Application for Purchase Order

- Pay for Services

- Accelerator for Invoices

- Bank Consolidation

- Money Management

- The General Ledger

FreshBooks

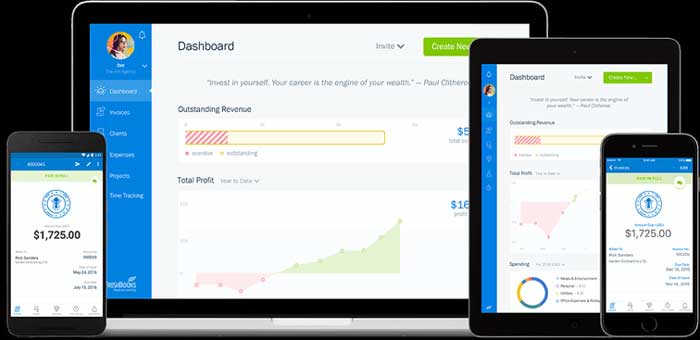

This award-winning accounting solution comes in first place on our list. FreshBooks was created with small businesses in mind, and it is all about providing SMBs and freelancers with powerful features in cost-effective plans.

Your customers can pay directly from the invoice with their credit card or through other payment gateway platforms like Stripe and PayPal.

It enables users to automate recurring payments, reminders, late fees, and other billing and invoicing processes. This allows them to devote more time to other aspects of their businesses.

FreshBooks also has a mobile application for iOS and Android devices. You can use this app to generate invoices for your clients no matter where you are. The monthly fee begins at $15.

Features:

- Online Billing

- Time Management

- Payments for Project Management

- Compliance with Taxes

- Late Payment Penalties

- Conversations in One Place

- Accounting Statements

A2X

A2X is an excellent bookkeeping software for ecommerce businesses. It routes data from various channels, such as Shopify and Amazon, to accounting platforms.

A2X also accepts multiple currencies and seller accounts. It, like other top applications, generates reports based on your transaction history.

Furthermore, the platform is very simple to use. All of its features are housed in an easy-to-use interface and are accessible with a few mouse clicks.

There are numerous plans available for the product.

Furthermore, it has a free trial version that allows you to easily test all of its features. Paid plans begin at $19 per month.

Features:

- The General Ledger

- Ecommerce-Centric

- Accounts for Multiple Sellers

- History of Transactions

- Reconciliation of Finances

- Amazon Connection

- Integration with Shopify

- Integration of Accounting Systems

Trolley

Trolley, formerly known as Payment Rails, is a global payment platform.

It enables users to automate payments to providers and sellers in over 200 countries and regions around the world. Tax reporting, real-time payout monitoring, foreign exchange tracking, automated mass payouts, and risk mitigation are all important features.

It also has powerful reporting capabilities, which enable detailed and accurate bookkeeping.

Furthermore, the product is known for its security features.

It has built-in fraud detection, bank account validation, 256-bit data encryption, and two-factor authentication for users.

Trolley, in a nutshell, has bank-level security.

Furthermore, it has IRS tax compliance features such as easy tax form collection.

Trolley also integrates seamlessly with third-party applications such as CRM, accounting, and productivity.

All Trolley features are available for free trial from the software provider.

Finally, paid plans begin at $49 per month.

Features:

- Automated Bulk Payments

- Tax Compliance with the IRS

- Reporting of Taxes

- Notifications of Payment

- Validation of a Bank Account

- Reconciliation on One Platform

- Security at the Bank

- Risk Reduction

Conclusion

Even though all of the bookkeeping software for startups listed here are ideal for fast-growing businesses, one stands out above the rest is FreshBooks.

It has a comprehensive set of features, not only because its pricing tiers are designed for growth.

Modules for online invoicing, expense tracking, time tracking, project management, payments, accounting reports, and tax management are available on the platform. In fact, it is a complete accounting platform. Furthermore, the product is simple to use and highly customizable.

As a result, users can easily configure the platform to meet their specific business requirements.