Business companies must need heavy equipment to support operations.

Unfortunately the supply or purchase of such heavy equipment was not as easy as the price was so high that if purchased in a cash manner it would interfere with the company’s finances.

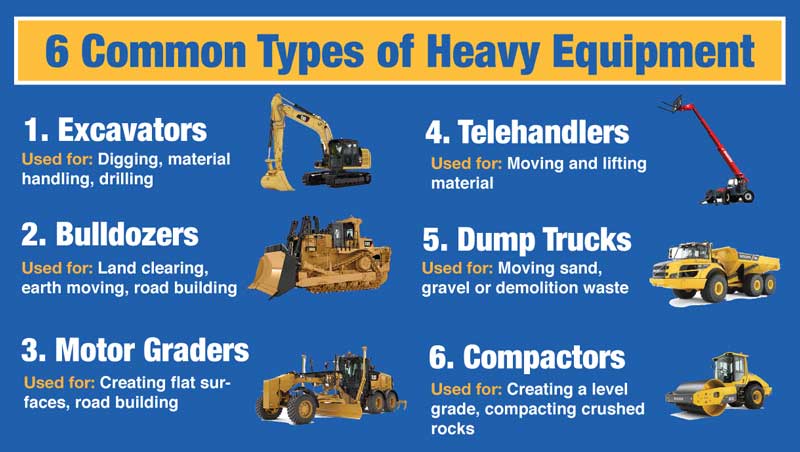

For this reason the heavy machinery loan system was the solution for the heavy machinery. Extensive heavy equipment from excavators, bulldozers, cranes, forklifts, and so on.

The step of lending or being familiar

For those of you who wish to propose heavy machinery may do the following ways or steps:

1. Weight control

The first step you can take is by determining the weight of the dial.

Determine what tools you need for your company. This weight tool you need should also be specific, for example, that the weight tools you need are forklifts, and forklifts like what you need are energy sources, capacity, and so on.

Understand the detail of the device you need in order to feel no remorse for the future.

2. New or secondhand

Once you have discovered what a tool specifically needs the next step you need to do is you have to determine whether the device you are going to foreign is new or used.

There are many differences between the new device and the used one.

For new heavy equipment, the performance was certainly much better than the previous one.

By buying a new weight you would benefit with several things such as low interest rates, light advance, and also first payments to the less.

Therefore, even if you will be able to make good use of this cheap used heavy equipment, the mortgage you will have to pay is much more.

3. Find the hardware dealer

Find a reliable dealer and indeed make an interesting offer.

To attract customers from many dealers makes profitable offers for the consumer, so you should be more careful about choosing them.

You have to compare one dealer with the other in order to avoid focusing on just one dealer.

4. Proposing heavy machinery financing

Once you find the dealer who offers sales of both used and new heavy-duty equipment you can apply for loan financing to lessor.

Use credible lessor as well as credible as csul. A trusted leasing had unquestionably legality.

Besides it has a clear system so you’ll understand the credit you’re applying.

In addition, the services rendered by trust leasing services vary from where not only to finance heavy machinery but also to multi-purpose financing and so on.

5. Prepare administrative documents

When about to submit the heavy gear to lessor you will have to prepare some paperwork that will qualify the administration.

If paperwork or administrative conditions are incomplete it will cause the financing of the heavy machinery to become unattainable.

Some conditions you have to copy identity CARDS with a partner, copy of a marriage certificate if you already have a family, copy of a family card, copy of NPWP, copy of the United Nations last 2 years, bank statements, paychecks over the last 3 months, and so on.

The requirements for complete administrative document you may ask the person directly because there are different conditions.

6. Confirmation

If you complete the necessary paperwork, you will get confirmation from lessor whether your financing applications are accepted or not.

If so you will proceed to the next process or else your application process will stop here.

7. Heavy – tool survey

Once confirmed by the leasing party, lessor will be given a heavy tool survey.

This survey can be with you or alone. Lessor also did not object to the conditions in the dealership, so you just accept them.

Therefore, these leasing financing are very practical for those of you who don’t have much time for financing.

8. Starting deposit

After you survey the last step is you must sign the binding agreement between you and lessor.

Not only do you have to pay the initial deposit as well as the interest rate.

A sample of the heavy machinery loan institute

Among them is:

1. Mandiri bank

Bank Indonesia has specific credit products for its heavy supply.

He said the company would be able to increase its interest rate by 25 basis points.

You could apply for co-operation with a local independent bank for heavy machinery.

The advantage of its co-operation with independent Banks is the ease in the credit process.

For partners with certain criteria, it is not required to surrender collateral. There are also deposits.

Generally, the time period for financing heavy equipment is 4 years for new tools and about 2 years for old tools.

For details on interest rates, mortgages, and so forth, you may immediately visit the local Mandiri bank.

2. Bri bank

However, the rupiah still had a chance to strengthen to rp9,100 per dollar, he said.

There’s a lot of capital goods that you can get through this bank.

For example, bri has been known as the bank of Indonesia.

As long as the conditions of the application are met, you can also have capital financing of heavy equipment.

Bri unit must be able to increase its interest rate by 25 basis points.

You can save yourself capital by simply raising a down payment to obtain the necessary weight tools.

Financing is also more flexible to your liking. You could do financing in another currency according to the company’s income.

Not only that, a fixed interest rate can also be adjusted to your needs and abilities.

3. Bukopin bank

Besides the two large Banks above, the bukopin bank also provides the heavy leasing equipment.

The credits provided for both new and used capital goods, the maximum credit span is 5 years, and the whole capital item (heavy equipment) can be insured.

Some of the requirements required to file heavy equipment are the legality of business, identity CARDS, minimum business experience 2 years, contract work, and a minimum company financial statement of the last 2 years.

4. Csul finance

Another financial institution you can use to finance finance is called csul finance.

The financial institution provided heavy equipment, trucks, and other industrial machines.

The requirements for a foreign application were very easy. For the first step, you can file an application for leasing on the official csul finance website.

The finance ministry will then contact you for further processing.

Conclusion

Heavy machinery loan is meant for those who want to develop heavy machinery but require substantial cash support.

Above some institutions that can be used to loan or loan easily.